some highlights:

- China emerged as the world’s largest gold market for jewelry and investment during the fourth quarter of 2011 as demand in India weakened. This is the first time China’s demand outpaced India’s in 11 quarters.

- Although gold imports from Hong Kong were cut in half in December, HSBC Global Research reports that overall gold imports from Hong Kong were 10 times the historical average from January through November 2011.

- China should consider its leadership as the No. 1 gold market a short-term position

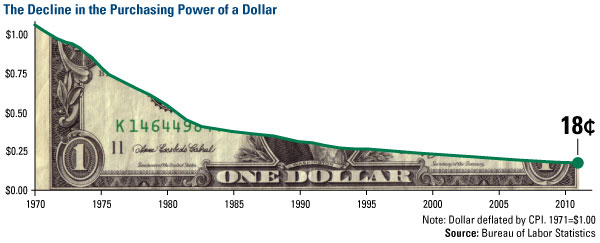

- For four decades following the end of the gold standard, the purchasing power of the dollar has been plunging: A dollar worth 100 cents in 1970 is now valued at a measly 18 cents.

-CIBC World Markets sees the secular bull market in gold continuing for “several years,” as the firm believes debt in major economies has reached a point “where financial and economic pressures will manifest themselves in ways that have up until now only been dreamed about.” With these manifestations, Ian McAvity equates gold to insurance.

-Here’s just one illustration of how cheap gold stocks appear compared

to gold. The yellow line represents the number of gold and silver

index units that can be purchased with one ounce of gold. While the

historical ratio averaged 4.5, today an investor can buy more than 8

units of the XAU to one ounce of gold. In other words, shares of gold

mining companies can be purchased at one of the cheapest levels in

nearly 30 years. Similar ratios persist between the GLD and the GDX.

-Here’s just one illustration of how cheap gold stocks appear compared

to gold. The yellow line represents the number of gold and silver

index units that can be purchased with one ounce of gold. While the

historical ratio averaged 4.5, today an investor can buy more than 8

units of the XAU to one ounce of gold. In other words, shares of gold

mining companies can be purchased at one of the cheapest levels in

nearly 30 years. Similar ratios persist between the GLD and the GDX.from Forbes Frank Holmes, Contributor

With CANADA STOCKS-TSX rallies to 5-month high on gold, U.S. data

-"Right now you're looking at gold and it looks like it wants to break out again," said Levente Mady, market strategist at Union Securities. "If we get past $1,800, the next stop is $1,925 and other than that the sky's the limit."

from Reuters

Demand for commodities? like Gold/Oil and Gas and Potash.

Would Gold Price keep on going up?

Thanks

Lawrence Tsang

No comments:

Post a Comment